What are life settlements?

A summary of the key features of the asset, market & SL’s expertise

SL Investment Management (SL) is recognised as one of the largest and most experienced ‘full service’ secondary life policy specialists in Europe. Established in 1990, SL has managed or advised over 40 collective investment vehicles comprising total assets valued in excess of $9.5bn. We have 30+ trained professionals, and an executive team who each average over 24 years’ experience in the sector.

We specialise in investment products based primarily on secondary insurance assets sourced in the UK and US. Our ‘full service’ solution includes product design and structuring, investment negotiation & acquisition, along with all aspects of managing and servicing portfolios. SL has a worldwide client base; our funds should be viewed as medium to long term investments and we pride ourselves on the development of successful long-term client relationships.

Aggregating policies into investment portfolios that will generate real value for investors is dependent upon accurate modelling and pricing together with rigorous asset selection. SL has its own in- house actuarial team and a proven and unique value-based pricing system, providing clients with unparalleled expertise in these areas. SL is also able to offer a wide range of advisory and management services to the owners of pre-existing Life Settlement portfolios.

Whether it be a one-off valuation, premium optimisation, due diligence, data cleansing, cash- flow model projections or client reporting, SL can provide an effective solution. SL has the flexibility to provide these services individually or as a full suite, on both an ad-hoc or periodic basis. SL is authorised and regulated by the Financial Conduct Authority.

“SL has been an important partner over the last 22 years, serving as investment advisor, and co-manager on 4 of our publicly listed Investment Trust Funds”

Peter Ingram | Allianz Global Investors

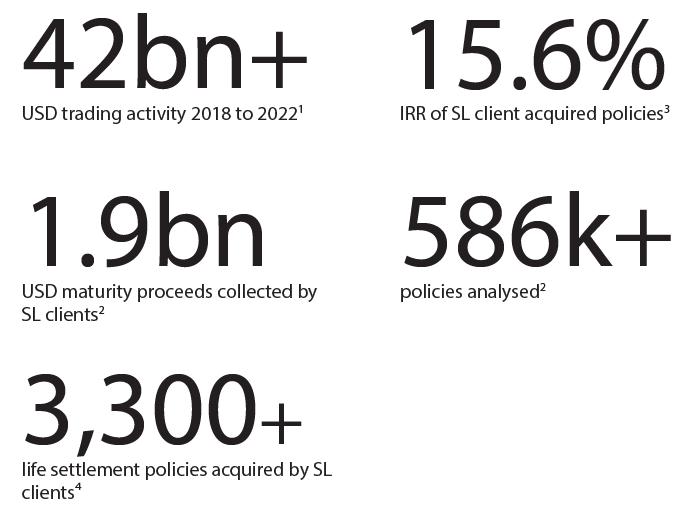

Key Metrics

-

- SL estimate of combined secondary and tertiary NDB market trading activity over 5 years; 2. Figure includes US life settlements and UK traded endowment policies; 3. Includes all SL life settlement purchases made since the introduction of VBT2008; 4. Excludes UK traded endowment policies.

Why Choose SL?

- Over 30 years of experience.

- Asset level IRR of 15.6%¹.

- More than half a million policies2 analysed with over 70,000 acquired on behalf of clients.

- 100% collection record of maturity proceeds for secondary life assets ($1.9bn of maturity proceeds2).

- All management functions controlled in-house e.g. $412m of life settlement premiums paid, daily monitoring for deaths, 0% losses due to policy lapses.

- Unfettered market access; we utilise all sources of secondary and tertiary policy acquisitions.

- Comprehensive due diligence on all transactions – Life Settlement due diligence approved by US counsel.

- Cautious and conservative, we build long term relationships and partnerships based on quality advice. Future performance projections are realistic and based on full, transparent actuarial calculations.

- Specialist teams in trading, fund management and administration, all underpinned by our in-house actuarial team.

- Fully cost transparent including origination, servicing and management.

- Proprietary actuarial pricing model achieves portfolios tailored to each product profile.

- Extensive in-house developed trading platform.

1. SL life settlement performance Index return since Feb 2014.; 2. Figure includes US life Settlements and UK traded endowment policies.

Life Settlements – Key Investment Characteristics

Life Settlement investment returns are fundamentally based on mortality and thus have low market correlation coupled with low volatility. This represents an excellent ‘market neutral’ alternative to traditional investment classes.

Life Settlements are life insurance policies purchased at a significant discount to the maturity amount (Net Death Benefit, NDB). This offers attractive returns typically around 8%-12% per annum in an open-ended fund structure. The counter-parties for NDB payments are US insurance companies with investment grade ratings typically A+ and above.

Insurance liabilities (including the commitment to pay the NDB on maturing policies) ranks above an insurance company’s commitments to equity and bondholders. The collection of the NDB upon maturity is very secure; hence why life settlements have a very attractive risk-return ratio when compared to an insurance company’s bonds.

Excellent risk-adjusted returns: Insurers’ policy liabilities rank above their equity and debt; yet the Gross Redemption Yield (GRY) on a life settlement is above the current GRY on insurance company bonds.

Reliably projected performance: Sophisticated actuarially-based models and value-based pricing systems are used to forecast life settlement investment performance.

Proven track record: The SL Life Settlement Performance Index indicates that policies purchased across vehicles managed or advised by SL have delivered 15.6% annualised growth1.

Low volatility: Life Settlement portfolio investments held to maturity are less volatile than traditional investments such as equities. Returns are primarily dependent upon mortality experience and secondary market values, which have historically changed slowly.

Minimal market correlation: ‘Buy to hold’ Investment performance is directly linked to the life expectancy of the insured. Therefore, the asset has low correlation to traditional equity, property and bond markets.

Net Yields of Various 10 Year Assets December 2023

Typical Life Settlement Policy Investment Example

Policy Attributes:

| Policy Type | Universal Life |

| Net Death Benefit | $400,000 |

| Average Annual Premium | $27,677 |

| Surrender Value | $1,000 |

| Age of Life Insured | 76 years |

| Pricing Life Expectancy | 8.25 years |

| Purchase Price | $106,000 |

| Life Company Rating | A+ |

IRR sensitivity:

| Life Expectancy- 6.25 years | 21.3% p.a. |

| Life Expectancy- 7.25 years | 16.8% p.a. |

| Life Expectancy- 8.25 years | 13.4% p.a. |

| Life Expectancy- 9.25 years | 10.7% p.a. |

| Life Expectancy- 10.25 years | 8.6% p.a. |

Life Settlement returns are fundamentally driven by the timing of the death of the insured life. Consequently, an investor is exposed to the ‘longevity risk’ of an insured life surviving longer than projected.

The valuation methodology employed by SL utilises mortality expectations set out in the VBT2015 (issued by the Society of Actuaries), along with additional adjustments that allow for future mortality improvements, and a period of lower mortality immediately proceeding the policy purchase.

Multiple policy specific factors are taken into account to ensure the projected returns are appropriate for the perceived risk.

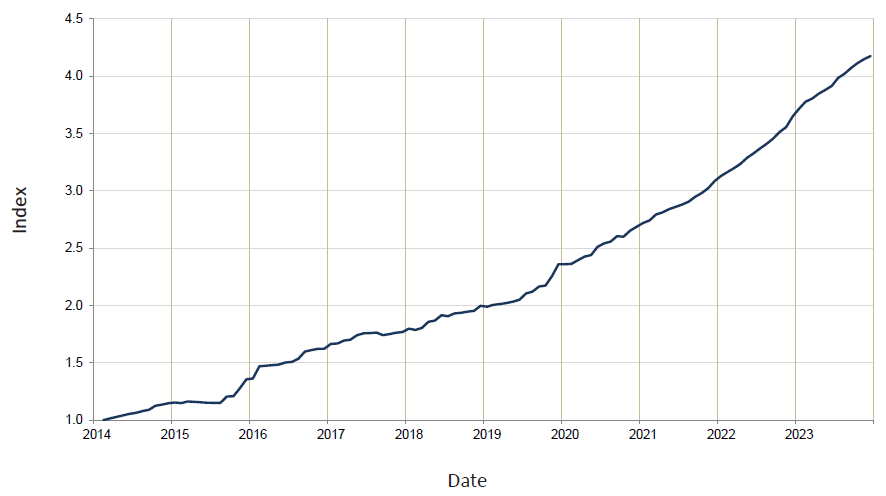

SL Life Settlement Performance Index

The SL life settlement performance index is a monthly index constructed from the underlying performance of all life settlements (‘Policies’) acquired by investment vehicles advised or managed by SL since February 2014.

The index launch date has been purposely chosen to coincide with the opening of investment vehicles that have targeted buying strategies.

A common and consistent valuation has been applied to all policies present in the index using the latest SL valuation curves, with the opening position derived from the actual acquisition price of each policy.

Monthly movements are calculated from aggregated policy cash flows including premium payments, sale proceeds, withdrawals, maturity proceeds and the unwinding of the valuation. The monthly movements are compounded to construct the index.

| Time Period | Cumulative Growth | Annualised Growth |

| 1m | 0.6% | 7.8% pa |

| 3m | 2.5% | 10.5% pa |

| 6m | 6.7% | 13.8% pa |

| 1y | 14.4% | 14.4% pa |

| 2y | 35.4% | 16.3% pa |

| 3y | 55.4% | 15.8% pa |

| 4y | 76.9% | 15.3% pa |

| 5y | 109.1% | 15.9% pa |

| 6y | 136.1% | 15.4% pa |

| 7y | 157.3% | 14.5% pa |

| 8y | 207.8% | 15.1% pa |

| 9y | 263.8% | 15.4% pa |

| to date | 317.5% | 15.6% pa |

source: SL Investment Management January 2024

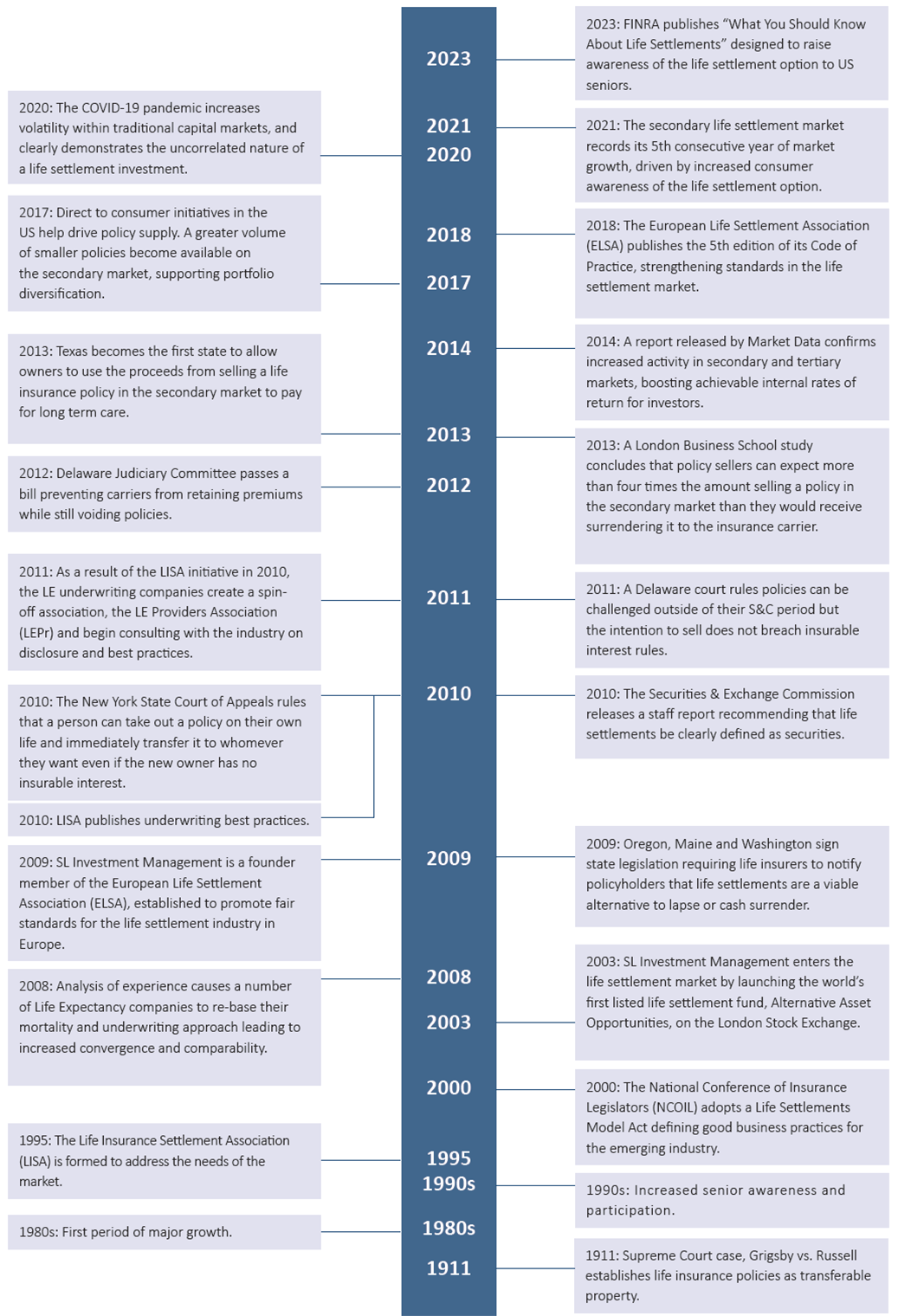

History of Life Settlements

Added Value

Life Settlements are life insurance policies issued on the lives of US seniors that have been sold by the original policy owner. The investment return to the new owner is the excess of the Net Death Benefit (NDB) received over the acquisition price of the policy plus premiums paid up to maturity. Typically, sensible target net returns for investors in an open-ended life settlement fund are 8% – 12% per annum. Returns can be higher in long-term closed-ended remits.

Although many life settlement fund managers frequently use more aggressive assumptions to indicate much higher returns are achievable, we believe in a more conservative approach, quoting what we believe to be realistic expectations of actual investor performance.

A number of key skills and targeted approaches can be used to create value in a life settlement investment, these include:

- Targeted stock selection based on the historical analysis of medical underwriter performance.

- Enhancing policy value through the prudent selection of service partners.

- Efficient sourcing of assets from secondary and tertiary markets, creating value through utilisation of broad supply channels, providing access to the widest range of policies at the best possible prices.

- Accurately modeled distribution of mortality events for each insured life leads to a rigorous and diligent valuation process, resulting in the ’right’ purchase price.

- Ongoing monitoring and active management of the portfolio.

Market Structure

SL utilises all available sources for acquiring policies. A typical transaction will involve the direct transfer of ownership from the original US senior into the name of the SL client portfolio. However, as the market has matured there has been an increasing component of re-trading, whereby existing investors onwardly sell policies. This ‘tertiary’ market is now estimated to account for more than half of transactions in the life settlement market.

In recent years SL has developed a very powerful and user friendly on-line submission and valuation platform that allows for a rapid and efficient turnaround of bids. Further, it is typical that SL will see identical policies offered through multiple sources in the market; our systems allow for an authoritative cross-referencing of data at both life insured and policy level.

This provides SL with a distinct advantage in terms of rapid response bidding, and aggregating of data enables us to identify particular value opportunities for investors in the market.

Our broad and independent acquisition approach has the benefit of increasing competition between brokers. This results in downward pressure on commission payments to intermediaries, which is to the ultimate benefit of both the policy vendor and secondary investor.

The level and quality of information provided from multiple sources also improves the overall quality of information in respect of each policy, enabling a better informed assessment to be made of the real underlying value to the investor.

Market Growth

The secondary life settlement market has shown significant growth in recent years. According to a survey carried out by The Deal1, the annual number of policies traded in the secondary market increased by 169% between 2015 and 2022.

Extensive marketing campaigns and a more direct to consumer approach have been the key drivers behind increasing public awareness of the life settlement option.

In 2023, the American Council of Life Insurers2 estimated that in the US there were around 259 million in force life insurance policies representing $21.8 trillion of death benefit.

The Conning3 2023 annual report on the life settlement industry projected that the gross life settlement market potential (policies that fit investor buying criteria) between 2023 and 2032 would average $224bn in face amount per year, with the annual volume increasing over that period as the baby boomer generation reaches retirement age.

By the end of 2032, Conning projects that there will be in excess of $39Bn of life settlements in force within investor portfolios.

Market penetration – a survey carried out by a large life settlement provider around the same time suggested that almost 90% of US seniors who owned a life insurance policy were unaware that they could sell their policy, demonstrating that there is great potential for significant further market growth.

Market Regulation

The life settlement market is regulated at state level, with each state having its own insurance commission to regulate and enforce the business of insurance within its state borders.

The market is maturing rapidly, with very few states now failing to include provision for life settlement regulation. Further, the level and quality of oversight is increasing in those states that have already adopted regulation.

SL has always been a strong supporter of consistent and rigorous regulation of secondary life markets, both in the US and the UK.

At federal level, a General Accounting Office report in 2012 concluded that the market successfully benefits US seniors. The report supports the opinion that the market is here to stay, with expectations that market regulation will continue to be developed and supported at both the state and federal level.

SL is a founding member of ELSA (the European Life Settlement Association) which was formed to encourage ethical practices in the life settlement market and promote investor understanding of the market.

Members must adhere to a strict Code of Practice, introduced by ELSA to establish common standards of best practice within the European life settlement industry – protecting the interests of Investors in the asset class.

1. Market analysis sourced from www.thedeal.com; 2. ACLI 2023 Life Insurers Fact Book; 3. Reports sourced from www.conning.com;

Q&A

Is this market beneficial for US seniors?

For “Seniors” (older policyholders), the development of the secondary market has created liquidity for a previously illiquid asset. Policyholders are now receiving a value for their policies where previously they were left to lapse or surrender at a nominal value. Over 80% of all life policies lapse prior to claim; so the biggest benefactors of a policy sale are always the policyholders themselves.

The secondary market provides a win-win arbitrage opportunity; the life insured gains more value than surrendering or lapsing a policy, whilst the secondary investor acquires a unique investment with low correlation.

Why do policy holders sell?

Prior to the establishment of the secondary market, if policyholders no longer wished to retain a policy they had two options: return the policy to the issuing life insurance company in return for the surrender value; or let the policy lapse by ceasing premium payments. Both options are highly unattractive when compared to selling the policy on the secondary market.

Typically, in excess of 80% of all terminated life policies lapse prior to maturity. The reasons are that policyholders often no longer have a need for the policy or, having retired, can no longer afford to pay the premiums on their policies. The emergence of a secondary market, with the possibility for the policyholder to obtain more value through a sale, offers an attractive alternative for seniors – providing liquidity to the policyholder for an otherwise illiquid asset.

A policy may be sold for various reasons, for example:

- Estate planning needs have changed

- The policy was used as key person insurance for a now retired employee

- Children have reached adulthood and are self- supporting

- Change in health status of insured

- Divorce

- Can no longer sustain premium commitments in retirement

Do You Trade In ‘Viatical’ Policies?

No. A Life Settlement is typically sold by a US senior aged 65 and over who has age-related medical impairments that, whilst not necessarily terminal, do reduce life expectancy.

This differs from viatical policies, where the lives insured are typically younger and have an advanced terminal illness with a life expectancy shorter than two years.

SL does not purchase viatical policies.

How do I select a Fund Manager?

Life settlements offer a particularly attractive investment opportunity for institutional investors. The choice of a proficient fund manager should always be of paramount importance to such investors.

SL Investment Management has produced a guidance note, 10 Key Questions to Ask Life Settlement Fund Managers, listing the key questions investors should be asking during their due diligence process to ensure a sound choice of investment manager.

Contact Us

If you would like to learn more about attractive investment opportunities in Life Settlements, or require any further information about SL, please contact:

Patrick McAdams | Investment Director

T: +44 (0)1244 317999

When Claire House Children’s Hospice opened in December 1998 they were only looking after 10 families. They now support over 400.

When Claire House Children’s Hospice opened in December 1998 they were only looking after 10 families. They now support over 400.