Please sign in or request literature to view the content.

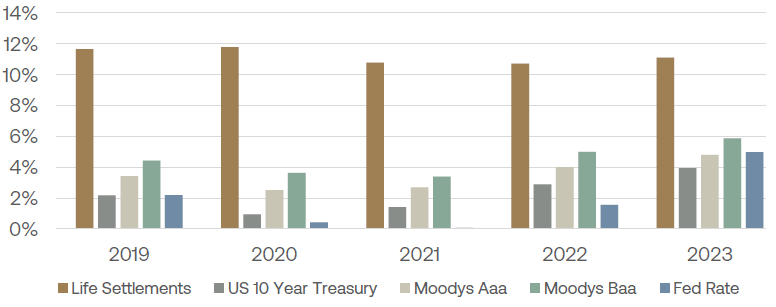

Life Settlement vs Fixed Income Yields 2019-2023

Rising inflation has been a key concern to investors in recent years. With central banks reacting to stem inflation by increasing risk free rates, this has seen a corresponding correction in fixed income yields.

One of the world’s most monitored interest rates, the US 10-year Treasury yield, has risen from 0.9% at the start of 2021 to 3.9% at the end of 2023. Whilst inflationary pressures ease there are mounting expectations of a reduction in risk free rates in the coming months – this should result in a corresponding reduction in fixed income yields as we progress through 2024.

In comparison, life settlement market yields are largely influenced by the supply and demand dynamics in the life settlement market. As such, life settlement market yields continue to demonstrate their low levels of correlation to fixed income yields, and represent an important alternative for investors considering diversification to help smooth volatility.

Strong & Favourable Returns

Life settlement market yields have remained strong and stable in recent years, against a backdrop of more variable US Fed rates and fixed income yields.

Market data indicates that life settlement market yields2 have remained consistently between 10-12% in recent years, with the AM Best credit rating8 for policies in a typical life settlement portfolio averaging A+.

The following graph shows how life settlement market yields, fixed income yields and the US Fed rate have changed over the past 5 years.

Life Settlement and Fixed Income Yields 2019-2023

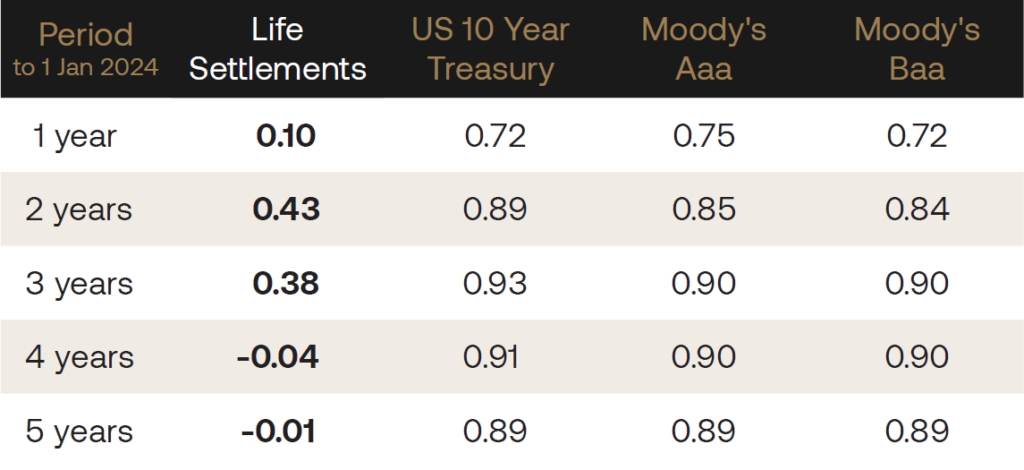

Low Correlation

Life settlements continue to demonstrate their low levels of correlation to movements in fixed income yields. The table below shows the correlation coefficient for life settlement market yields and fixed income yields, against changes in the underlying US Fed rate.

Life Settlement and Fixed Income Correlation Coefficients vs US Fed 1-5 years

The correlation coefficient is a statistical measure of the strength of the relationship between the relative movements of two sets of data. A correlation of -1 shows a perfect negative correlation, while a correlation of 1 shows a perfect positive correlation. A correlation of 0 shows no linear relationship between the movement of the two variables.

The analysis demonstrates the low level of correlation between Life Settlement market yields and the US Fed Rate. Whilst, as expected, fixed income yields show a high degree of correlation.

[end]

Notes:

- Both sets of analysis are based upon data compiled by SL Investment Management using 30 day rolling averages.

- Life settlement market yields are derived from SL Investment Management observed market data for the period 1 December 2018 to 31 December 2023. Yields are aggregated and averaged across all life settlement market sectors. Targeted investment strategies can achieve yields in excess of these averages.

- US 10-year Treasury data sourced from US Department of the Treasury.

- Moody’s Aaa is the Moody’s Seasoned Corporate Bond Yield Aaa daily averages, not seasonally adjusted.

- Moody’s Baa is the Moody’s Seasoned Corporate Bond Yield Baa daily averages, not seasonally adjusted.

- US Fed rate is the Effective Federal Funds Rate daily average, not seasonally adjusted.

- Moody’s and US Fed Rates sourced from the Federal Reserve Bank of St. Louis economic research data.

- A+ is the weighted average AM Best credit rating for the BlackOak Fund portfolio as of 31 March 2024.

Disclaimer

BlackOak Fund is an investment vehicle suitable for institutional and professional investors only and is not suitable for semi-professional, private or retail investors. This material is intended for “investment professionals” as defined in article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 and must not be acted or relied upon by other persons.

The information and opinions published herein do not constitute an invitation or offer to buy or sell life settlements or other financial instruments, nor an invitation or offer to undertake other transactions. They are published purely for information purposes. The information and opinions published herein constitute neither recommendations nor guidance for decisions concerning your investments and other matters, and do not have any advisory character whatsoever. Therefore, before making any investment or other decisions, you should seek the advice of a qualified specialist.

Past performance is not a guide to future performance, nor a reliable indicator of future results or performance. By investing, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest.

This material and the copyright in the content are owned by SL Investment Management Limited. The presentation and content cannot be reproduced, modified, republished or redistributed without the prior permission of SL.Introduction to SL Investment Management 2024

Please sign in or request literature to view the content.

Claire House Easter egg fund-raiser

Claire House Easter Egg Fund-raiser

In preparation for Easter, One City Place held a fund-raiser in support of Claire House – a local children’s hospice supporting seriously and terminally ill children and their families.

One City Place’s building manager coordinated donations of chocolate Easter eggs from occupants, including SL Investment Management (“SL”), RSM UK and Sykes Cottages. These were donated to children receiving care in hospital over Easter, unable to make it home with their families.

Nicola Lacey, Administration Manager at SL said,

“We’ve supported Claire House for a number of years through various fund raising initiatives, so it was great to be involved in the Easter egg appeal. A small but important gesture.

“The Claire House team do a fantastic job in supporting children and families who find themselves, through no fault of their own, under very difficult circumstances. We’re privileged to have made a small contribution in support of the team and their work over the years.”

When Claire House Children’s Hospice opened in December 1998 they were only looking after 10 families. They now support over 400.

When Claire House Children’s Hospice opened in December 1998 they were only looking after 10 families. They now support over 400.Whether they’re a trustee or a carer, a fundraiser or an administrative assistant, every member of the Claire House team has one thing in common: a passion for improving the lives and making a difference to children and families who need it most.

Claire House Children’s Hospice helps seriously and terminally ill children make the most of the time they have however long or short that may be. By providing specialist nursing and end of life care, as well as emotional support Claire House helps families through some of the toughest times of their lives.

For more information we encourage you to visit their website:

https://www.clairehouse.org.uk

SL Investment Management.

April 2023

Disclaimer

Links to third party websites are owned and operated by independent parties over which SL Investment Management Ltd (“SL”) has no control (“3rd Party Website”). Any link you make to or from the 3rd Party Website will be at your own risk. Any use of the 3rd Party Website and any information you provide will be governed by the terms of the 3rd Party Website, including those relating to confidentiality, data privacy and security.

SL is not in any way associated with the owner or operator of the 3rd Party Website or responsible or liable for the goods and services offered by them or for anything in connection with such 3rd Party Website. SL does not endorse or approve and makes no warranties, representations or undertakings relating to the content of the 3rd Party Website.

Ivory Coast Humanitarian Mission

Ivory Cost – Diabetes, Hypertension & Breast cancer screening

SL Investment Management (“SL”) are delighted to be supporting Audrey Mangly in a humanitarian mission to the Ivory Coast in February 2023. Audrey joined SL in 2017 working with the Trading, Technical & Actuarial Team, and is an extremely valued member of the team.

In January Audrey shared with her colleagues,

“I will be traveling next month to the Ivory Coast, west of Africa where I am originally from, for a few weeks. After 12 years, I will rediscover the country of my childhood and of my youth; which I’m very excited about. The main reason for my trip is the charity work we are currently putting together; my team and I are going out there to help the population of my village in the western part of Ivory Coast.

“This is part of my role as a volunteer for a non-for-profit organisation called “Association d’Aide Humanitaire EducSanté Diabète” registered in Belgium. The organisation aims to provide access to primary health care, social and other assistance to people living in remote areas with limited access to health care.”

The mission will provide free breast cancer, diabetes and hypertension screening for the population of Mahapleu, a town in the western part of the Ivory Coast.

The specialist team of doctors and nurses will provide emergency care where necessary, providing therapeutic education for diabetics and hypertensives, and organising referrals to the main hospital for those who are identified as potentially having breast cancer.

The team also intend to donate medical equipment and medications to the local health centre of Mahapleu, with the purpose of helping to improve sanitary conditions.

More information can be found on the group’s Facebook page:

https://www.facebook.com/aahesd.be

We wish you well with your expedition Audrey!

SL Investment Management.

February 2023

Disclaimer

Links to third party websites are owned and operated by independent parties over which SL Investment Management Ltd (“SL”) has no control (“3rd Party Website”). Any link you make to or from the 3rd Party Website will be at your own risk. Any use of the 3rd Party Website and any information you provide will be governed by the terms of the 3rd Party Website, including those relating to confidentiality, data privacy and security.

SL is not in any way associated with the owner or operator of the 3rd Party Website or responsible or liable for the goods and services offered by them or for anything in connection with such 3rd Party Website. SL does not endorse or approve and makes no warranties, representations or undertakings relating to the content of the 3rd Party Website.

UK to Spain Cycle July 2022 – UNICEF

UK to Spain Cycle July 2022 – UNICEF

SL Investment Management (“SL”) are delighted to be supporting Alec Taylor in his UK to Spain cycle to raise monies for UNICEF’s work with the child victims of the war in Ukraine. Alec has been with SL for over 25 years, and is now a Director of the company working with the Strategic Executive Group and Board.

Alec said:

“I’m cycling from my home near Chester in the UK to Spain in July 2022 primarily in support of UNICEF’s work with the child victims of the war in Ukraine. It’s also a journey I’ve wanted to do in memory of my younger brother, Andy, who sadly passed away 2 years ago.

“The first stage of the journey takes me from Chester to Portsmouth, broadly following UK cycle route 5 through the Midlands and south. After the ferry to Saint-Malo, it’s across Brittany to join the EuroVelo 1 down the west coast of France – before heading off east to tackle the Pyrennes south of Perpignan.

“The final stretch is onto Palafrugell, around 70 miles north of Barcelona, where I’ll meet up with the family for a summer break.

“Thanks to my wife Layla, Maisie & Zoe who have indulged my obsession with doing this trip. And to my colleagues at SL Investment Management who have supported me wholeheartedly in this venture.”

The total journey is estimated to be 1,200 miles, and Alec plans to complete this in just over 3 weeks.

More information can be found on Alec’s JustGiving page:

https://www.justgiving.com/fundraising/alec-taylor3

We wish you well with your adventure Alec!

SL Investment Management.

June 2022

Disclaimer

Links to third party websites are owned and operated by independent parties over which SL Investment Management Ltd (“SL”) has no control (“3rd Party Website”). Any link you make to or from the 3rd Party Website will be at your own risk. Any use of the 3rd Party Website and any information you provide will be governed by the terms of the 3rd Party Website, including those relating to confidentiality, data privacy and security.

SL is not in any way associated with the owner or operator of the 3rd Party Website or responsible or liable for the goods and services offered by them or for anything in connection with such 3rd Party Website. SL does not endorse or approve and makes no warranties, representations or undertakings relating to the content of the 3rd Party Website.

- 1

- 2

When Claire House Children’s Hospice opened in December 1998 they were only looking after 10 families. They now support over 400.

When Claire House Children’s Hospice opened in December 1998 they were only looking after 10 families. They now support over 400.